Author: Nataniel Snider

Mental illness impedes an individual’s ability to manage emotions, relationships, and decision-making effectively, and it may interfere with saving money, paying bills on time, or overcoming financial challenges. Many people experience financial anxiety. Their concerns center around meeting daily expenses, their credit score and having enough emergency savings for unexpected challenges in life. 1. Develop […]

Read More

Anyone who donates their time, effort or finances towards an effort they believe in can be considered a philanthropist; however, family charities tend to be more structured than individual efforts. Context-sensitive philanthropy can bring economic and social goals closer together. One example is Cisco Systems’ network administrator training program which addresses local talent shortage while […]

Read More

Financial advice can often contain misguided and disingenuous advice, so it is critical that individuals differentiate fact from fiction when making financial decisions. Misconceptions and myths regarding saving, investing and money management can stymie wealth creation if we let them. Let’s examine some common financial misconceptions to debunk them. 1. It’s not worth saving if […]

Read More

How to Plan For Retirement at Any Age

- May 09, 2023

Life can be unpredictable and your retirement plan may experience setbacks along the way. To make up lost ground, adapting your lifestyle or working longer may help make up any shortfalls in savings. Assuming you haven’t already, continue making the maximum contributions to your 401(k) and IRA (and take advantage of federally approved catch-up contributions […]

Read More

Before investing in cryptocurrency, it’s essential that you fully comprehend its benefits and risks. Since cryptocurrencies can be unpredictable investments tools, diversifying your portfolio might be best. Cryptocurrencies are decentralized currencies that don’t rely on being supported by any central authority, making them an attractive way to invest in digital assets safely and securely. It’s […]

Read More

The Psychology of Spending and Saving

- Apr 12, 2023

People’s financial beliefs and attitudes are formed from both nature and nurture, such as a person’s upbringing and family values. A recent study revealed that personality traits can influence how you save and spend money. People who shared certain personality traits were significantly more likely to save than those without these characteristics. Saver The psychology […]

Read More

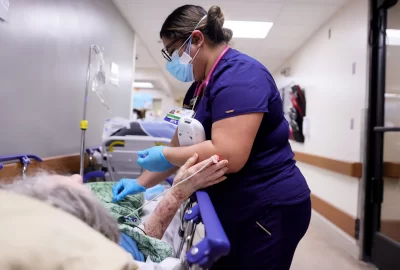

The impact of rising healthcare costs on retirement savings is often disregarded, yet it should be one of your key considerations when planning for your golden years. Medicare covers some medical expenses, but retirees must budget for deductibles, premiums and other out-of-pocket costs. They may need to purchase supplemental coverage such as long-term care insurance […]

Read More

How to Negotiate Lower Interest Rates on Your Loans

- Mar 16, 2023

If you’re having difficulty making ends meet, it may be worth exploring negotiating lower interest rates on your loans. Doing so can reduce monthly payments and ultimately save you money in the long run. Typically, smaller lenders and credit unions are more willing to negotiate on rates than larger banks and other financial institutions because […]

Read More

How to Start a Successful Etsy Shop for Extra Income

- Mar 09, 2023

Are you searching for ways to generate extra income? Starting an Etsy shop could be the ideal solution. It’s relatively straightforward to set up and doesn’t need much overhead. The initial step in starting a business is selecting an industry. Make sure to select something you are passionate about and that sells well. 1. Decide […]

Read More

Sustainability and socially responsible investing is becoming more widely popular, as evidenced by Morgan Stanley’s survey which revealed 85% of individual investors are interested in it. Sustainable investing emphasizes a company’s social and environmental performance. It offers an alternative solution to traditional investment strategies, providing potential solutions for complex issues like climate change. The Millennial […]

Read More